The Definitive Guide for Offshore Business Formation

Table of ContentsFascination About Offshore Business FormationExamine This Report about Offshore Business FormationAbout Offshore Business FormationThe Buzz on Offshore Business FormationRumored Buzz on Offshore Business FormationWhat Does Offshore Business Formation Do?

Generally speaking, the Cons will certainly vary in a case-by-case situation. The country where the business is signed up will certainly impose corporate earnings tax on its globally revenue. On top of that, the business will be needed to report its globally revenue on its home country's income tax return. The procedure of establishing an overseas firm is extra complex than establishing a regular corporation.

Establishing an overseas company doesn't supply any type of financial savings since you still pay tax obligation on your worldwide revenue. If you wish to minimize your international tax worry, you should take into consideration establishing several firms instead of one offshore entity. When you relocate money out of an overseas area, you will be responsible for that earnings in your house country.

9 Simple Techniques For Offshore Business Formation

The trade-off is that offshore business sustain costs, prices, and also various other disadvantages. Nevertheless, if you prepare to integrate offshore, then you ought to learn about the advantages and disadvantages of integrating offshore. Every place and jurisdiction is various, and also it's hard to actually understand truth efficacy of an overseas firm for your service.

If you have an interest in evaluating Hong Kong as an option, contact us to learn more and one of our experts will certainly walk you through Hong Kong as an overseas unification choice (offshore business formation).

Discover the advantages and disadvantages of establishing an offshore firm, consisting of privacy and also minimized tax responsibility, as well as learn just how to register, develop, or include your company beyond your nation of residence. In this post: Offshore business are businesses signed up, established, or integrated beyond the nation of residence.

Getting The Offshore Business Formation To Work

If a lawful opponent is pursuing lawsuit against you, it generally involves an asset search. This guarantees there is money for payments in the event of a negative judgment against you. Creating overseas firms as well as having actually assets held by the abroad firm suggest there is no more a connection with your name.

The statutory commitments in the operating of the offshore entity have actually likewise been simplified. Due to the lack of public registers, proving possession of a business registered offshore can be hard.

One of the major drawbacks is in the location of compensation and distribution of the properties and earnings of the overseas company. Returns revenue received by a Belgian holding business from a firm based elsewhere (where earnings from international resources is not exhausted) will pay business income tax obligation at the typical Belgian rate.

The 6-Second Trick For Offshore Business Formation

In Spain, keeping tax of 21% is payable on rate of interest as well as returns repayments, whether residential or to non-treaty nations. Where rewards are paid to a firm that has share resources that has actually been held during the prior year equal to or over 5% holding back tax obligation does not apply. This implies that tax is deducted prior to monies can be paid or moved to an offshore business.

The major drive of the regulation is in compeling such business to demonstrate beyond a reasonable doubt that their hidden tasks are genuinely executed in their respective overseas facility which these are undoubtedly typical company tasks. There are huge tax risks with carrying out non-Swiss corporations from beyond Switzerland, for instance.

A further factor to consider is that of reputational danger - offshore business formation.

The Ultimate Guide To Offshore Business Formation

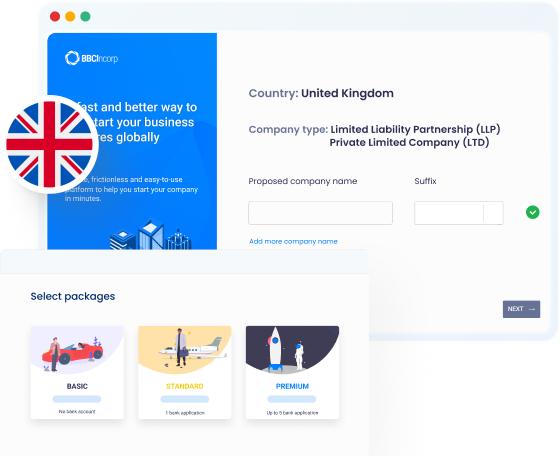

So the offshore business enrollment process need to be undertaken in total supervision of a firm like us. The need of choosing offshore business visit this site right here enrollment procedure is necessary before setting up a business. As it is called for to satisfy all the problems after that one must refer to an appropriate organization.

Capitalize on no taxes, bookkeeping as well as bookkeeping, and also a fully transparent, low investment endeavor. When choosing a treatment that calls for proper attention while the satisfaction of policies as well as policies after that it is essential to adhere to particular actions like the services provided in Offshore Company Formation. To find out more, please total our and a rep will certainly touch eventually.

India, China, the Philippines, Poland, Hungary, Ukraine, Brazil, Argentina, Egypt, and South Africa are a few of the finest nations navigate to these guys for offshore growth.

The Offshore Business Formation PDFs

There are lots of reasons that entrepreneurs might want establishing an overseas company: Tax advantages, low conformity prices, a supportive banking setting, as well as brand-new profession chances are some of one of the most commonly mentioned factors for doing so. Here we consider what entrepreneurs require to do if they wish to establish up a Hong Kong offshore company (offshore business formation).

This is because: There is no requirement for the company to have Hong Kong resident directors (an usual need in various other countries) as Hong Kong takes on a plan that prefers overseas firms established up by international investors. offshore business formation. There is no need for the firm to have Hong Kong resident websites shareholders either (an usual need in other places) foreign business owners do not need to partner with a local citizen to refine a Hong Kong business arrangement.